Meta has introduced a new technology in WhatsApp called “Private Processing,” designed to enable artificial intelligence features...

AirPlay, developed by Apple, is a proprietary protocol that allows users to wirelessly stream content from iOS...

Users of Windows 7 or Windows Server 2008 may have encountered an issue wherein setting the desktop...

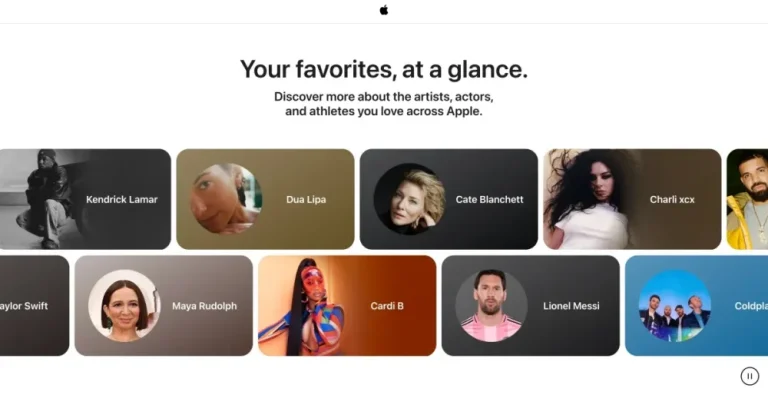

Apple recently launched a new platform titled Snapshot on Apple, designed to showcase updates and highlights from...

Waymo has recently announced a partnership with Toyota to explore the development and application of robotaxi technologies,...

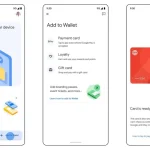

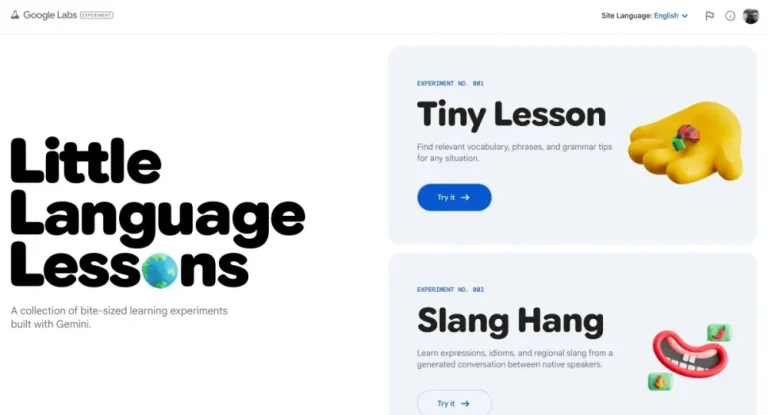

Google recently introduced an experimental feature through Google Labs called Little Language Lessons, a suite of language-learning...

According to a report by The Wall Street Journal, Netflix has outlined two ambitious goals to be...

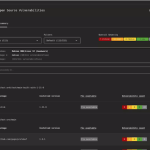

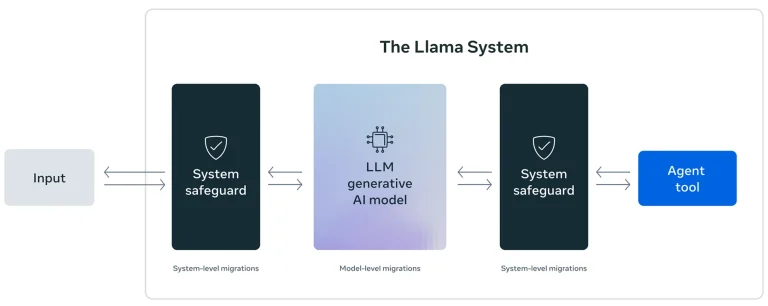

Meta has unveiled a new tool designed to fortify artificial intelligence systems against increasingly sophisticated cyber threats....

Europol has joined forces with law enforcement agencies from eight countries to combat criminal networks operating under...

One of the most prevalent attack vectors targeting WordPress involves disguising malicious code as a harmless plugin....

Since its debut in 2023 and the subsequent rollout of numerous updates, the note-taking service NotebookLM has...

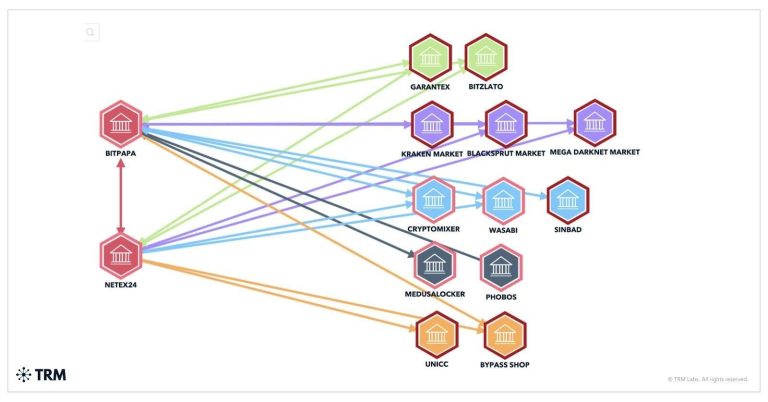

Following the dramatic shutdown of the cryptocurrency exchange Garantex, a new player has rapidly emerged in its...

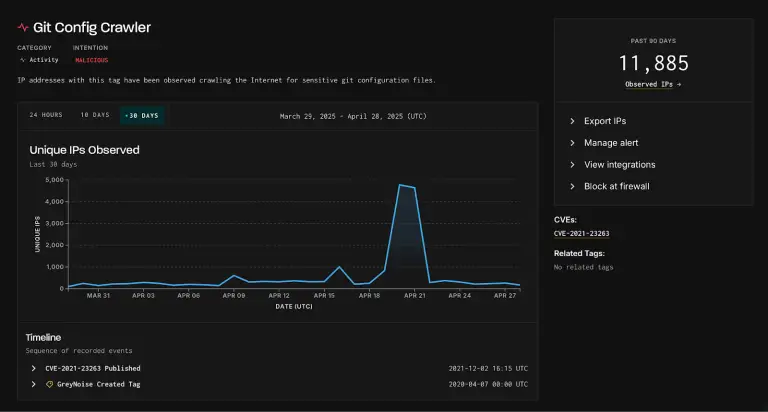

In recent days, cybersecurity experts have observed a disturbing surge in activity aimed at accessing configuration files...

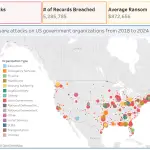

A comprehensive study conducted by Rubrik Zero Labs has confirmed that in 2024, nearly 90% of IT...

The majority of residents across Spain, Portugal, and southern France have resumed normal life following a widespread...