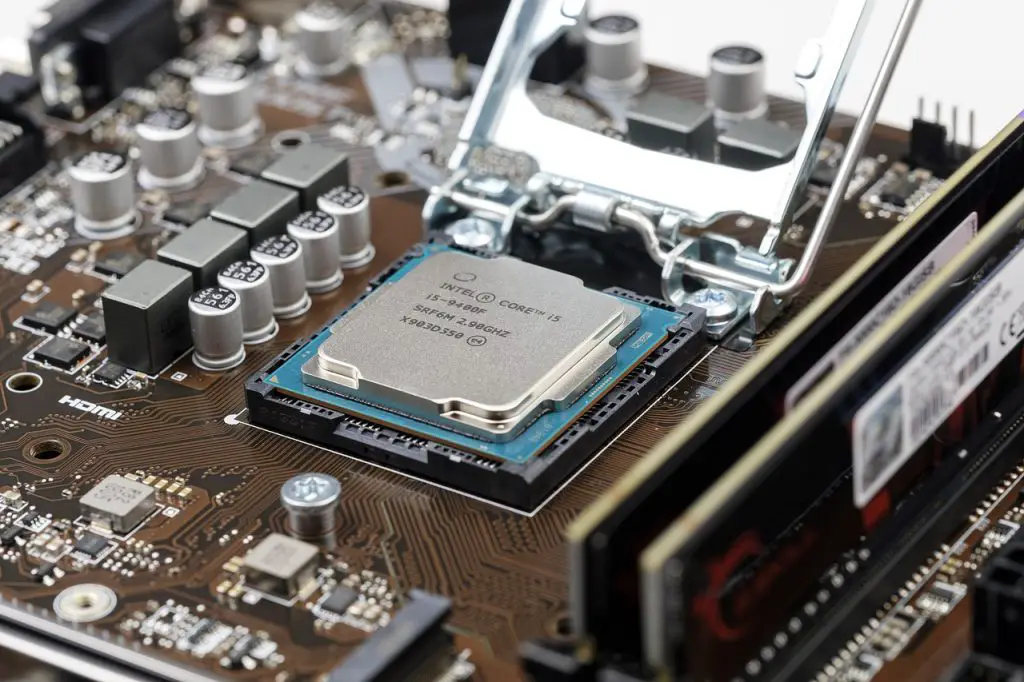

In August 2024, Intel announced the layoff of 15,000 employees in an attempt to mitigate an internal crisis. However, even such drastic measures failed to salvage the leadership of then-CEO Pat Gelsinger, who announced his retirement by December, stepping down from all executive roles at Intel.

Gelsinger’s departure was likely less than voluntary. Subsequent legal disputes between Intel’s board of directors and Gelsinger suggest that the executive leadership had reached its limits in tolerating the company’s ongoing troubles—his retirement, therefore, may be seen more as a forced exit.

Intel now plans to lay off 21,000 employees, aiming to reduce operational costs and streamline its management structure—amounting to a staggering 20% of its workforce.

Previously, Intel’s board appointed industry veteran Lip-Bu Tan as CEO in hopes of reversing the company’s downward trajectory. Tan is committed to divesting non-core assets and focusing on developing more competitive products. Just last week, Intel agreed to sell a 51% stake in its programmable logic chip division, Altera, to Silver Lake Partners.

Tan now intends to deepen reforms within Intel, focusing on flattening the management hierarchy and restoring an engineering-driven culture. As part of this strategy, another round of sweeping layoffs is planned—approximately 21,000 employees, or one-fifth of the current workforce, are expected to be let go.

While Intel has yet to publicly announce the move, insiders report the company may unveil the plan later this week. As of the end of 2024, Intel employed 108,900 people, down from 124,800 in 2023—a reduction of 15,900 employees over the year.

Once a dominant force in the processor market, Intel has steadily lost ground in recent years as its chip fabrication processes fell behind those of its competitors, eroding its market share. Sales have declined for three consecutive years, with mounting losses compounding the crisis.

Analysts remain skeptical about Intel’s recovery. Even with Lip-Bu Tan at the helm, many believe the company’s revenues are unlikely to rebound to previous levels—some warn they may never return to their former heights.