Following the dramatic shutdown of the cryptocurrency exchange Garantex, a new player has rapidly emerged in its place — a platform called Grinex, which, according to analysts at TRM Labs, may be little more than a rebranded incarnation of the original enterprise, preserving the same operational schemes and personnel.

In April 2022, Garantex was sanctioned by the U.S. Office of Foreign Assets Control (OFAC), with similar measures subsequently adopted by the United Kingdom and the European Union. The primary allegation: facilitating money laundering operations for darknet markets and hacker collectives, with transactions reportedly exceeding $100 billion.

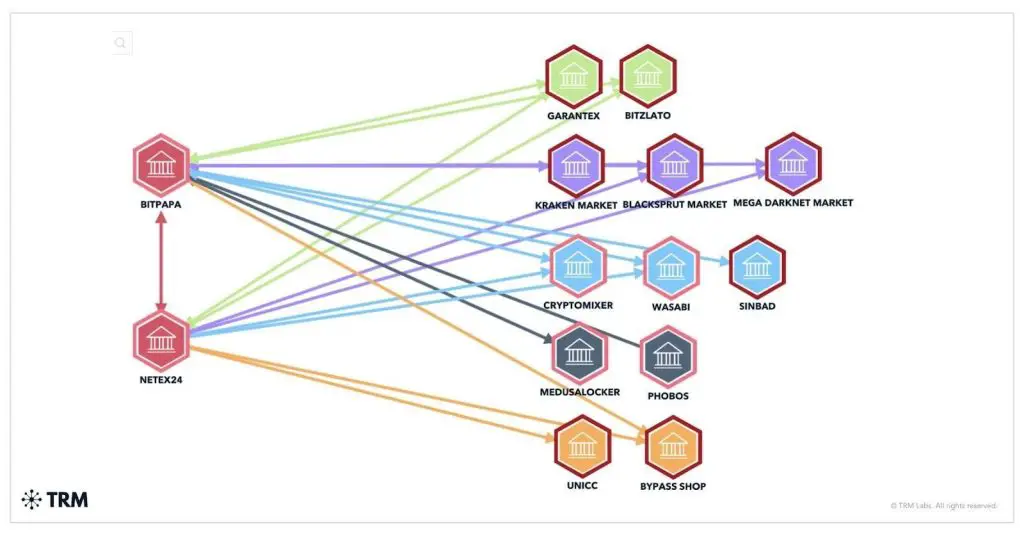

In March 2025, U.S. authorities seized Garantex’s domain infrastructure, and one of its administrators, Alexey Beschokov, was apprehended while vacationing in India. Another individual implicated in the case — Alexander Mira Serda — was also formally charged. TRM Labs’ investigation revealed that the platform had been used to process funds linked to the Conti ransomware group, as well as several illicit marketplaces including Hydra, Mega, Kraken, OMG!OMG!, and Solaris.

In the wake of the arrests and infrastructural takedowns, mentions of a new platform — Grinex — surfaced almost immediately in Telegram channels affiliated with the group. Marketed as a “platform with familiar functionality,” Grinex mirrored Garantex’s user interface with uncanny precision. Even before its official launch, Grinex had succeeded in attracting segments of both the former exchange’s staff and clientele, further reinforcing suspicions of its continuity.

TRM Labs also noted that Grinex declared its intention to “embrace” Garantex users and initiate reimbursements for frozen assets through a new tokenized mechanism. This involved the A7A5 token, notably announced just two weeks prior to Garantex’s liquidation.

Telegram channels once associated with Garantex began promoting Grinex as a means of fund recovery and A7A5 as a bridge for transferring assets to the new platform — all of which suggests a meticulously orchestrated effort to evade sanctions.

Additional actors in this cryptocurrency maze include the platforms ABCEX and Rapira. The former is directly tied to Garantex founder Sergey Mendeleev, while the latter has already absorbed part of the defunct exchange’s user base. Taken together, these developments underscore how easily illicit financial structures can adapt — circumventing restrictions through rebranding, the creation of new tokens, and the exploitation of decentralized infrastructure.

The story of Grinex serves as a stark reminder of the inherent complexities in policing financial flows within the crypto realm. Even under the weight of international sanctions and the arrests of key figures, such projects swiftly reconfigure, reemerge under new identities, and persist in their operations — preserving old networks and vested interests beneath the veneer of reinvention.