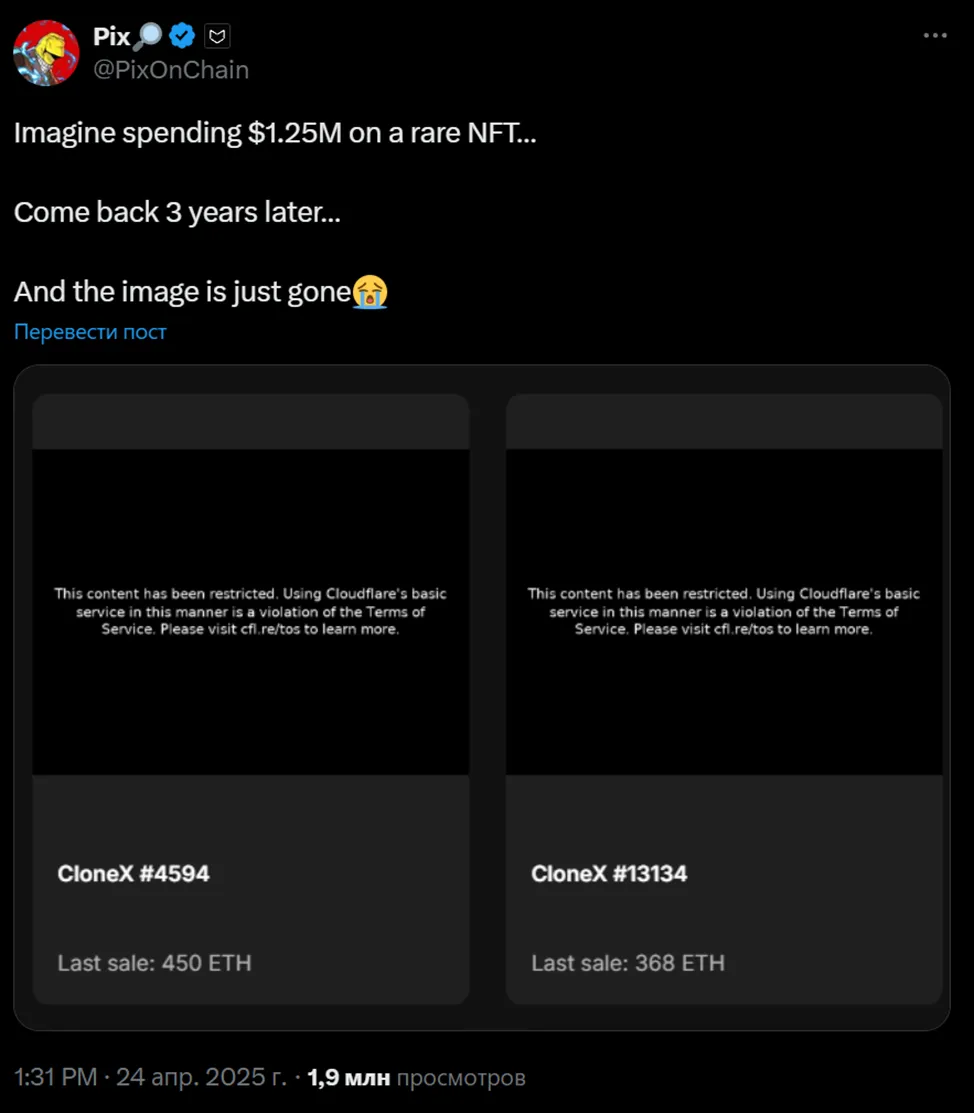

One user recounted the incident on social media (@PixOnChain).

On April 25, thousands of NFTs from the CloneX RTFKT collection—once sold for millions of dollars—suddenly vanished from the internet. In their place appeared a stark message: “Access to this content is restricted. The use of Cloudflare’s basic service in this manner violates the Terms of Service.” Although the images were eventually restored, their brief disappearance served as a powerful reminder of the ephemeral nature of digital assets and the rapid decline of interest in what were once the darlings of the crypto world.

The missing NFTs belonged to the CloneX collection, created by RTFKT Studios in collaboration with renowned Japanese artist Takashi Murakami. The project launched with the backing of Nike, which had acquired RTFKT in 2021, during the height of the NFT frenzy. At that time, investors viewed NFTs as promising assets, comparable in value to physical commodities like gold or silver. Yet the disappearance of more than 19,000 digital objects—worth tens of millions of dollars in Ethereum—has cast serious doubt on the notion of NFTs as “eternal” assets.

Around 5 a.m. Eastern Time on April 24, 2025, thousands of images from the collection became inaccessible. Instead, users encountered a black screen with white text citing a violation of Cloudflare’s usage policies. A linked page explained that users on free, Pro, or Business plans are prohibited from mass-distributing large files such as images or videos without subscribing to a specialized paid service. Failure to comply empowers Cloudflare to redirect traffic or implement measures to maintain service quality.

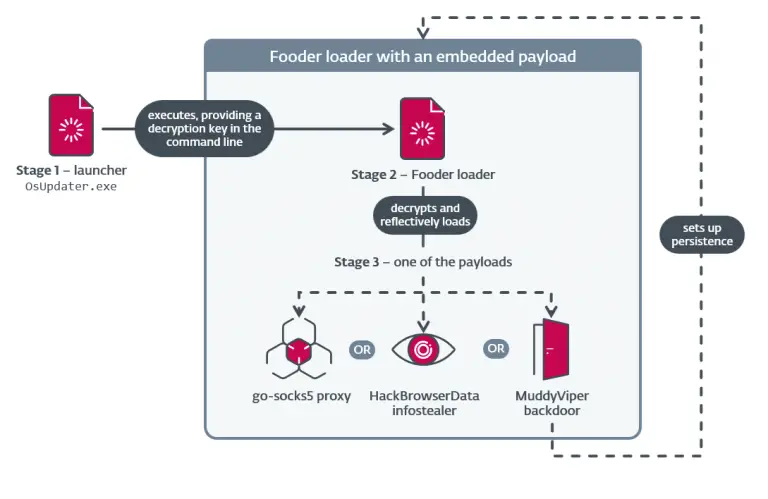

The original vision for NFTs promised their permanent existence on the blockchain. In practice, however, many projects—including CloneX—stored their images off-chain on external servers or centralized storage systems. It was precisely this architectural choice that rendered the tokens visually useless the moment server access was lost.

Nike acquired RTFKT in late 2021 amid the NFT boom. Although the acquisition sum was undisclosed, venture firm Andreessen Horowitz had previously valued RTFKT at $33 million, a valuation that helped the studio raise $8 million in funding. At the time, digital collections seemed poised to become a major new frontier for brands. Yet, three years later, Nike opted to wind down the project. No official reason was given, but the broader cooling of the NFT market and dwindling consumer interest were apparent.

After Nike withdrew its support, Samuel Cardillo, RTFKT’s former Chief Technology Officer, was left as the sole custodian of the collection—where once a team of 12 had worked. Now acting as a consultant, Cardillo managed the data migration process. Initially, images had been hosted on DigitalOcean servers with Cloudflare providing connection security.

Cardillo explained that he intended to migrate the assets to ArWeave, a decentralized storage solution offering long-term preservation. However, as Nike retained final control over the process, decisions were not his alone to make. As a temporary measure, he resorted to Cloudflare’s free plan to maintain public access to the images during migration. It was this downgrade to a free plan that led Cloudflare to restrict image delivery.

According to Cardillo, the switch was inevitable: maintaining a paid account no longer made sense after the project’s official shutdown and the cancellation of future token drops. He notified the RTFKT community about the situation on Discord and responded to numerous inquiries on social media platform X, all while working tirelessly to restore access.

Meanwhile, a class-action lawsuit was filed in Brooklyn federal court against Nike. The lead plaintiff, an Australian citizen, claimed that Nike’s termination of support for RTFKT had caused substantial losses among NFT holders. The lawsuit alleges that buyers had expected long-term stewardship of the assets, only to see their investments rendered worthless.

Cardillo declined to comment on the legal proceedings but reaffirmed his belief in the foundational promise of NFTs. He stressed that blockchain assets should not become mere instruments of speculation but rather should be leveraged to create genuinely useful applications.

The CloneX incident has laid bare the fundamental vulnerabilities of digital assets: despite promises of permanence and invulnerability, the underlying storage infrastructure often remains precariously susceptible to service policy changes or the withdrawal of financial backing. The episode involving Cloudflare and Nike served as a stark reminder: owning a token does not guarantee the eternal survival of the digital object it represents.