Seven Asian nations have conducted a sweeping crackdown on transnational cyberfraud, arresting over 1,800 individuals and freezing tens of thousands of bank accounts linked to criminal activity.

At the heart of the investigation were so-called “scam centers”—clandestine operations specializing in large-scale financial deception, including schemes known as “pig butchering,” in which victims are lured into fabricated investment or romantic relationships to extort substantial sums of money.

The operation, dubbed Frontier+, was orchestrated by Singaporean police and took place throughout April and May, involving law enforcement agencies from Hong Kong, South Korea, Malaysia, the Maldives, Thailand, and Macau. The investigation was initially triggered by two cases in which Singaporean citizens transferred large sums to accounts provided by fraudsters. Traces led swiftly to bank accounts in Malaysia, where the joint efforts of both countries enabled authorities to freeze part of the stolen funds almost immediately.

In the course of further actions, 33,901 individuals were screened for possible involvement in at least 9,200 fraud incidents, with the total estimated damage to victims reaching $225 million. Authorities froze over 32,000 bank accounts tied to illicit activity and seized $20 million in assets, including cash and funds held on digital platforms.

According to Singaporean officials, 106 individuals were arrested within Singapore alone, suspected of orchestrating 1,300 criminal schemes with a cumulative loss of $30 million. During searches, police blocked 714 accounts holding nearly $8 million in misappropriated funds. Charges against those arrested range from unauthorized access to systems and the use of forged documents to money laundering.

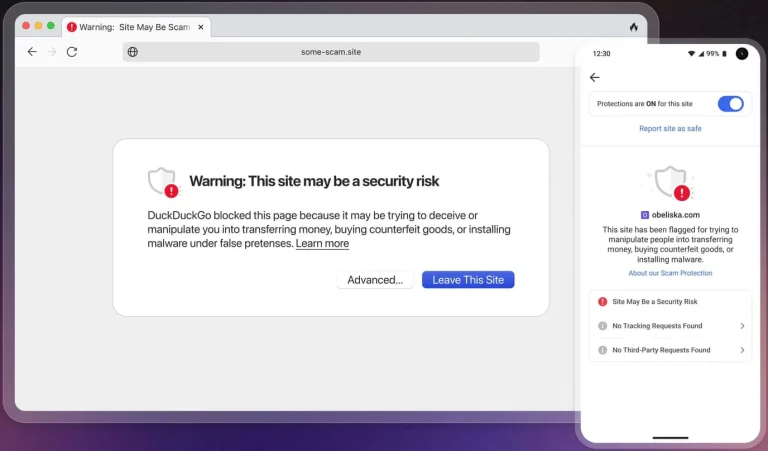

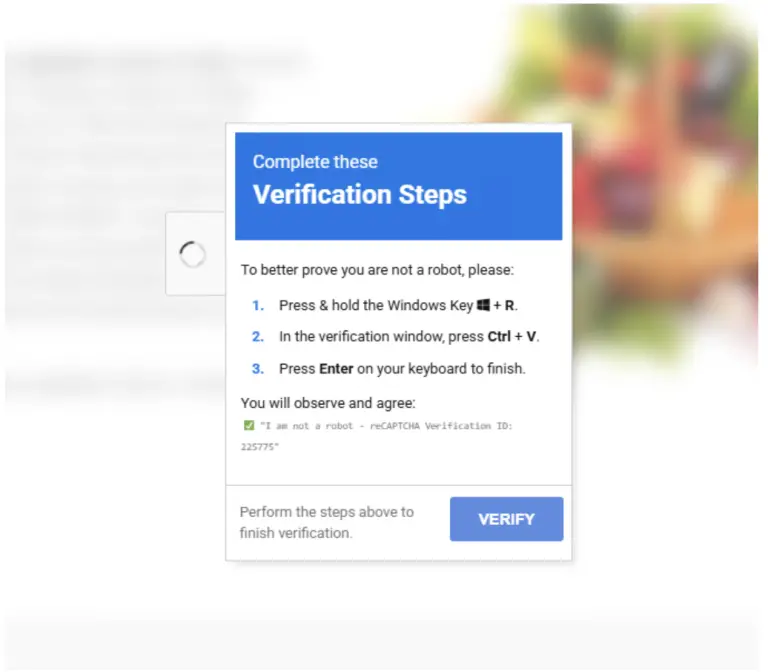

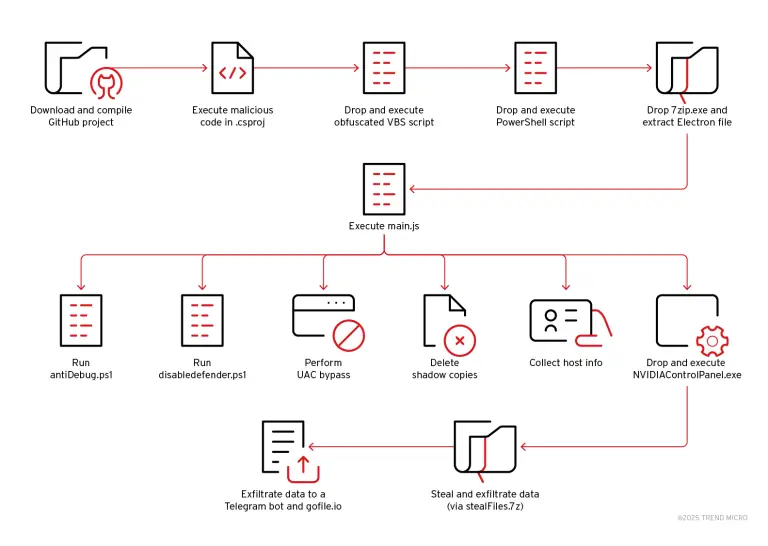

A distinctive aspect of the investigation was the transnational nature of the operations—the fraudsters operated across multiple jurisdictions simultaneously. As Singaporean police noted, threats of this magnitude demand a multinational response, emphasizing that “no country can combat these schemes in isolation, but together we are stronger.” Criminals are employing increasingly sophisticated tactics, including fake websites, bogus social media accounts, fraudulent dating apps, and forged government notifications.

One of the key outcomes of the operation was the establishment of robust coordination between participating law enforcement bodies. Singaporean authorities affirmed their commitment to continued collaboration under the Frontier+ initiative, including real-time sharing of operational intelligence and the tracking of suspicious transactions.

Hong Kong police added that at least ten countries were involved in the operation, including Australia, Canada, and Indonesia—highlighting the growing scope of cyberfraud and the need for engagement from nations previously unassociated with Asian transit routes.

Concurrently, similar crackdowns are unfolding across other regions. Recently, five men pleaded guilty to laundering nearly $37 million stolen from U.S. citizens through cryptocurrency scams orchestrated via centers in Cambodia.

In another case, Malaysian police conducted a raid in Kuala Lumpur, apprehending 16 individuals suspected of operating within an international fraud syndicate. The group reportedly defrauded victims—mostly Singaporean residents—of over $41 million while impersonating bank employees.

This latest Asian operation underscores the intricate global web of criminal activity. International syndicates exploit social engineering, sprawling logistics networks, and encryption technologies to obscure their tracks. Yet, the success of Frontier+ demonstrates that swift action, intelligence sharing, and coordinated enforcement can deliver a decisive blow to these criminal networks.