The Federal Bureau of Investigation and the U.S. Department of Justice have successfully seized more than $8 million in the stablecoin USDT, stolen through a widespread fraud operation known as “Pig Butchering.” This form of cybercrime is built on long-term deception, leveraging fabricated romantic relationships and fraudulent investment schemes to exploit victims.

A civil forfeiture complaint was filed on February 27, 2025, by the U.S. Attorney’s Office in Ohio, detailing the seizure of $8.2 million in Tether tokens traced as part of an extensive swindle. Among the victims was a Cleveland resident who, in pursuit of false promises, liquidated her retirement savings and transferred over $650,000 in cryptocurrency to a fictitious platform.

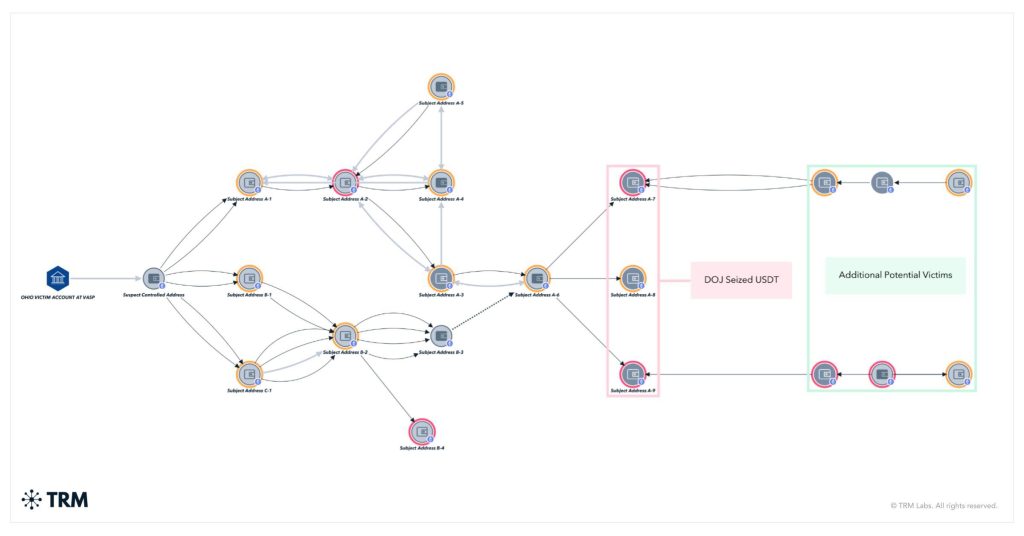

The investigation relied heavily on blockchain analytics tools. FBI specialists meticulously tracked the movement of funds across multiple layers—from centralized exchanges to the Ethereum and TRON blockchains, through decentralized finance (DeFi) protocols, and ultimately to final storage wallets. Despite the intricate laundering methods employed, the analysis revealed recurring patterns and reused wallets, enabling agents to reconstruct the complete trail of transactions.

According to TRM Labs, the FBI identified distinct hallmarks of Pig Butchering schemes, which formed the foundation for dual legal proceedings—one for fraud and another for money laundering. Notably, in the summer of 2024, Tether proactively froze the associated assets, and in November, burned the tokens and reissued them to law enforcement. This pivotal step laid the groundwork for the restitution process.

The court documents show that the suspects operated multiple wallet addresses, funneling funds from various victims. The Department of Justice employed a dual forfeiture strategy—seizing part of the funds as proceeds of fraud and the rest as laundered assets. This comprehensive approach ensures the possibility of returning assets both to identified victims and to those yet to come forward.

Pig Butchering scams are rapidly escalating in scale, often intertwined with forced labor and human trafficking in Southeast Asia. Vulnerable users of social media and dating apps are targeted and convinced to invest in seemingly lucrative opportunities. Initial returns are fabricated to entice larger investments, after which victims are abruptly cut off from their funds.

As the complaint emphasizes, such schemes initially emerged among Chinese criminal syndicates targeting their own citizens, but have since proliferated globally—especially during the pandemic. Perpetrators often operate from scam compounds in Cambodia and Myanmar, enlisting trafficked individuals to perpetrate the fraud. The use of cryptocurrency allows these criminals to bypass traditional financial oversight and fund transfer systems.

TRM Labs asserts that this case exemplifies the tangible results of collaboration between public agencies and private-sector partners. The deployment of advanced forensic tools and precise legal strategies enables not only the recovery of digital assets but also a measure of justice for victims, many of whom lost their life savings.