In Tennessee, a school district lost over $3 million to fraudsters. In March, Johnson, a financial officer in the district, received what he believed to be an official request from Pearson, a supplier of educational materials. However, the sender’s address was counterfeit—the fraudsters used a deceptive domain ending in “.quest” instead of the official one.

The scammers exploited the domain pearson.quest, which closely resembled Pearson’s legitimate address, the company that provides educational resources for online learning. After exchanging banking details and payment dates with the fraudsters, the school employee initiated two transfers totaling $3.36 million. These funds had been allocated through a government program to support school education.

Two weeks later, the district’s bank reported suspicious activity, but by then the money had already been transferred to other accounts. To date, only $742,000 of the stolen funds has been recovered.

A U.S. Secret Service agent launched an investigation and traced the funds to bank accounts belonging to a 76-year-old Texas resident, John Crowson. He admitted to opening the accounts and receiving the transfers, but claimed he had done so at the request of his fiancée, whom he had met a few times before she allegedly traveled abroad to resolve inheritance matters. Crowson was convinced that he was helping her recover her father’s inheritance, which she supposedly couldn’t transfer to U.S. accounts.

Three other individuals interviewed also confirmed that they had opened accounts to receive funds at the request of people they had met online. Such individuals, known as “mules,” often become involved in money-laundering schemes without fully understanding their role. According to the FBI, these schemes are frequently built on false romantic or trusting relationships that scammers establish with their victims, a tactic known as a romance scam.

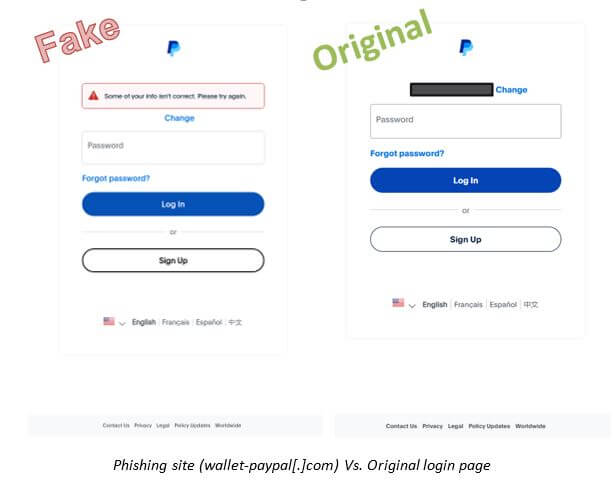

These kinds of schemes are part of email-based business compromise fraud (BEC), where criminals send emails from forged or hacked addresses to convince company employees to transfer money to fraudulent accounts. In 2023 alone, such scams resulted in losses of at least $2.9 billion in the U.S.