Since mid-last year, DRAM and NAND prices have been on an upward trend, and many have likely noticed a significant increase in the cost of memory and SSDs compared to the same period last year. However, this price surge may be coming to an end. According to the latest spot market price trend report from TrendForce, there are no signs of a significant short-term rebound in DRAM and NAND flash memory prices.

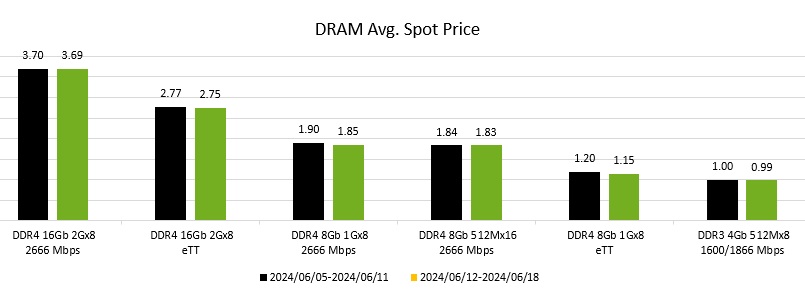

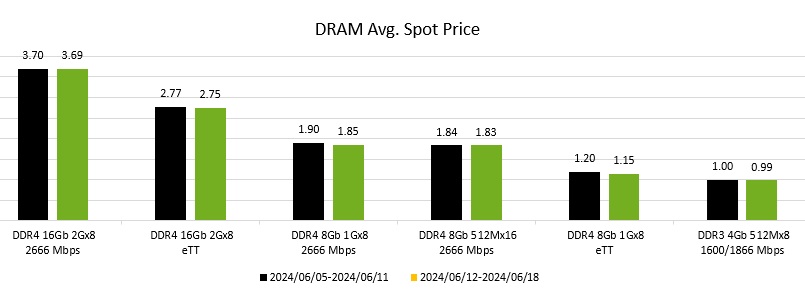

The spot market price trend for DRAM diverges from the contract market, with no signs of improvement. In addition to an oversupply of inventory at memory module factories, the consumer market remains weak, with no seasonal demand boost in sight.

Furthermore, since the end of May, a crackdown on smuggling in China has led to a continuous decline in the spot market price of re-balled DRAM chips, making a short-term rebound unlikely. Overall, the average spot price of mainstream chips dropped by 2.54% compared to last week. Re-balling is a technique for repairing DRAM chips by replacing the solder balls at the bottom of the chip. In many cases, this allows the DRAM to function again, but such chips are generally less reliable than new DRAM.

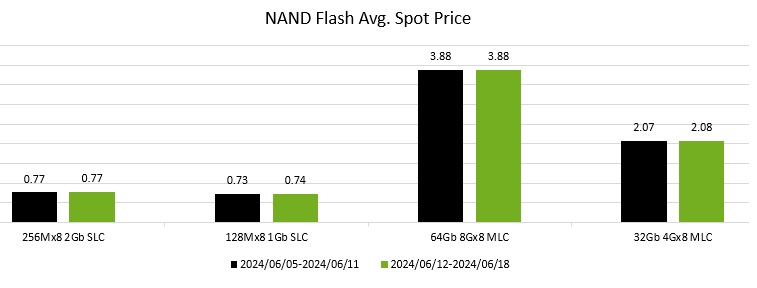

Similarly, due to ample inventory at SSD manufacturers, the spot market for NAND flash memory remains sluggish. Despite price cuts by spot suppliers, demand has not yet recovered. This has led to a persistent disparity between spot prices and contract prices, with market participants remaining cautious about the potential for restocking demand in the third quarter. This week, the spot price of 512Gb TLC wafers fell by 0.57%, to $3,309.

Overall, due to weak demand, the DRAM and NAND flash memory markets face significant pricing challenges, and TrendForce anticipates that prices will not rebound in the short term. Additionally, upstream manufacturers have begun to halt NAND flash production cuts and are preparing to increase output, a move that could significantly impact NAND flash supply and pricing.