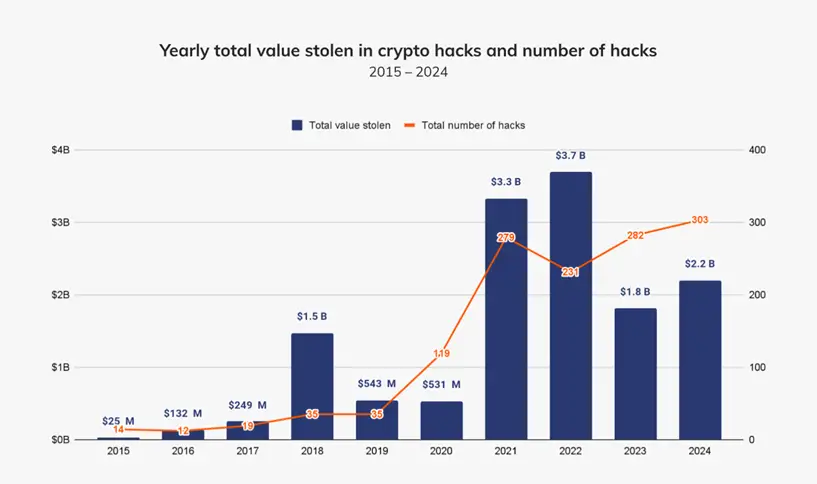

The cryptocurrency hacking market continued its remarkable growth in 2024. According to Chainalysis, the total value of stolen funds reached $2.2 billion, marking a 21.07% increase compared to 2023. The number of recorded attacks also rose, from 282 incidents in 2023 to 303 in 2024.

The first half of the year proved particularly active. Between January and July, $1.58 billion was stolen, an 84.4% increase from the same period in 2023. However, the pace of attacks noticeably declined in the latter half of the year, which experts attribute to potential geopolitical shifts.

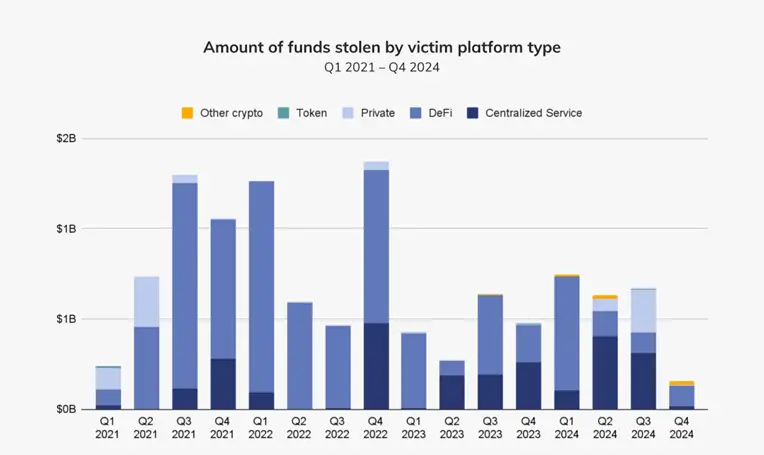

The preferences of cybercriminals in targeting platforms have shifted. In 2024, a significant number of attacks were directed at centralized services, such as DMM Bitcoin ($305 million) and WazirX ($234.9 million). In contrast, previous years saw a focus on decentralized DeFi platforms, known for prioritizing rapid market entry over robust security. Nonetheless, the compromise of private keys remains the primary method for gaining unauthorized access to user assets.

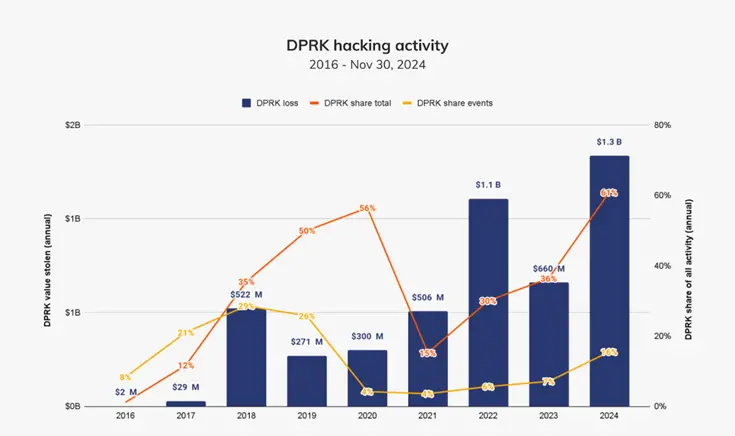

Private key compromises accounted for 43.8% of all stolen funds in 2024. Following these breaches, attackers used laundering techniques involving decentralized exchanges, mixers, and cross-chain bridges to obfuscate the trail of stolen assets. North Korean-linked attacks were particularly noteworthy, with hackers from the DPRK stealing $1.34 billion in 47 incidents—representing 61% of the year’s total cryptocurrency theft, more than double their 2023 figure.

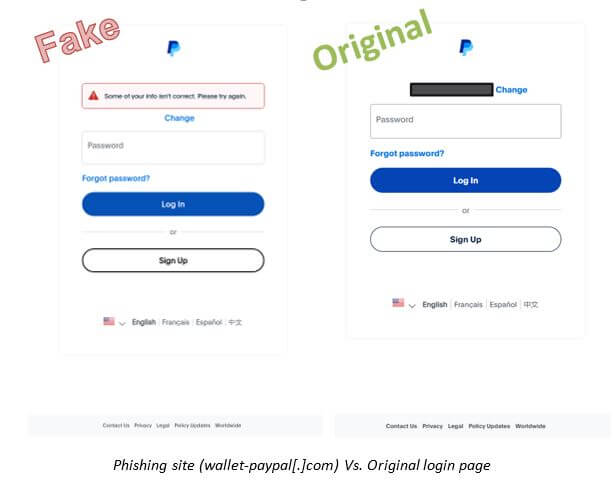

The sophistication of North Korean attack methods continues to evolve. Hackers have increasingly infiltrated cryptocurrency firms using fake identities and elaborate employment schemes. This tactic not only facilitates theft but also grants access to critical corporate information. In a notable case, the U.S. Department of Justice charged 14 North Koreans who, under the guise of remote IT specialists, amassed $88 million through data theft and extortion.

Geopolitical factors have also influenced hacking activity. Following a June 2024 meeting between Russian and North Korean leaders, the total volume of stolen funds fell by 53.73%, potentially reflecting a reallocation of resources or a shift in priorities for North Korean cyber operations. However, this trend may reverse toward the year’s end, as hacking activity often spikes during the holiday season.

The largest attack of 2024 targeted DMM Bitcoin. Exploiting vulnerabilities in the platform’s infrastructure, hackers stole 4,502.9 BTC, worth $305 million. Although the company reimbursed affected clients, it subsequently decided to shut down the exchange in December, transferring its assets to SBI VC Trade.

The rising scale of cryptocurrency theft underscores the urgent need for stronger security measures. Collaborative efforts between private companies and government entities, advancements in technology, and adherence to stringent security standards are vital. Such actions will not only protect user assets but also bolster long-term trust in the cryptocurrency market.