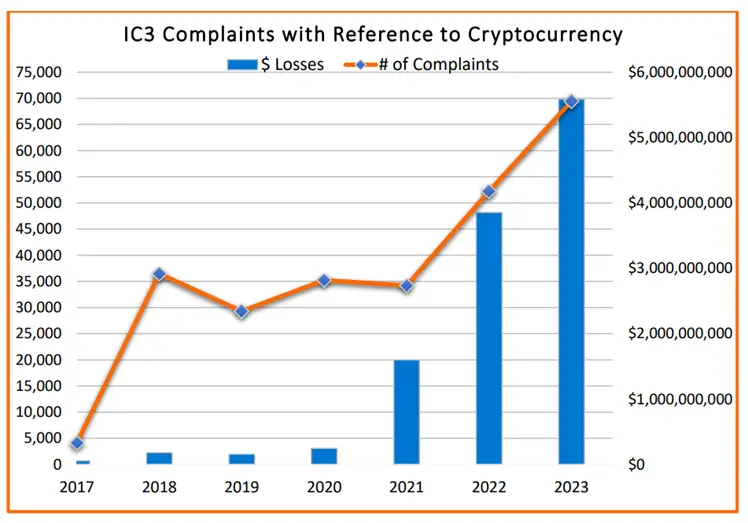

According to the FBI, 2023 set a record for cryptocurrency fraud, with losses from such crimes exceeding $5.6 billion. This data is based on nearly 70,000 reports submitted through the Internet Crime Complaint Center (IC3). The increase in losses represented a 45% rise compared to the previous year, driven primarily by investment scams, which accounted for 71% of all cryptocurrency losses.

The surge in damages was largely attributed to investment schemes, which made up a significant portion of the total losses. Other types of fraud included tech support scams, call center schemes, and instances where criminals impersonated government officials.

U.S. citizens suffered the greatest financial losses, with total damages reaching $4.8 billion. Other countries affected by cryptocurrency fraud included the Cayman Islands ($196 million), Mexico ($127 million), Canada ($72 million), the United Kingdom ($59 million), India ($44 million), and Australia ($25 million).

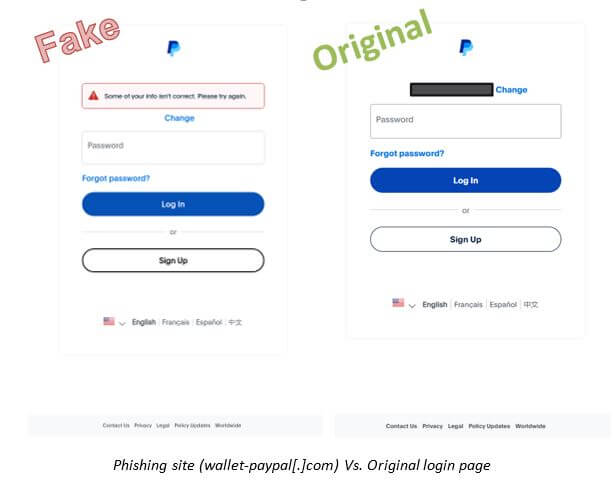

In its report, the FBI highlighted several trends in cryptocurrency fraud that gained prominence in 2023. One of the most prevalent schemes was “Pig Butchering,” where criminals lured victims to fraudulent websites through dating apps and social media platforms.

Another widespread scam involved liquidity mining fraud, in which victims were promised high returns for placing assets in liquidity pools. Additionally, criminals developed fake blockchain-based gaming apps, offering cryptocurrency rewards as a way to gain access to users’ wallets.

A particularly notable scheme involved “cryptocurrency recovery” frauds. In these cases, criminals contacted victims of previous scams, offering fake services to recover stolen funds, while demanding advance payment for their “services.”

The IC3 report also provided several recommendations for safeguarding against cryptocurrency fraud. Key advice included:

- – Be skeptical of promises of easy profits;

- – Always verify the legitimacy of investment platforms before making deposits;

- – Insist on meeting financial advisors in person, and be wary if they refuse;

- – Use separate cryptocurrency wallets for gaming and investments;

- – Periodically review wallet permissions using trusted tools, and revoke access when necessary;

- – Avoid liquidity mining schemes that fail to account for market fluctuations;

- – Be cautious of private companies offering cryptocurrency recovery services that require upfront payment;

- – Independently verify the identities of callers by returning their calls using contact information found through reliable sources.

The FBI emphasized that the decentralized nature of cryptocurrency and the irreversibility of transactions make it attractive to fraudsters, underscoring the importance of heightened user vigilance.