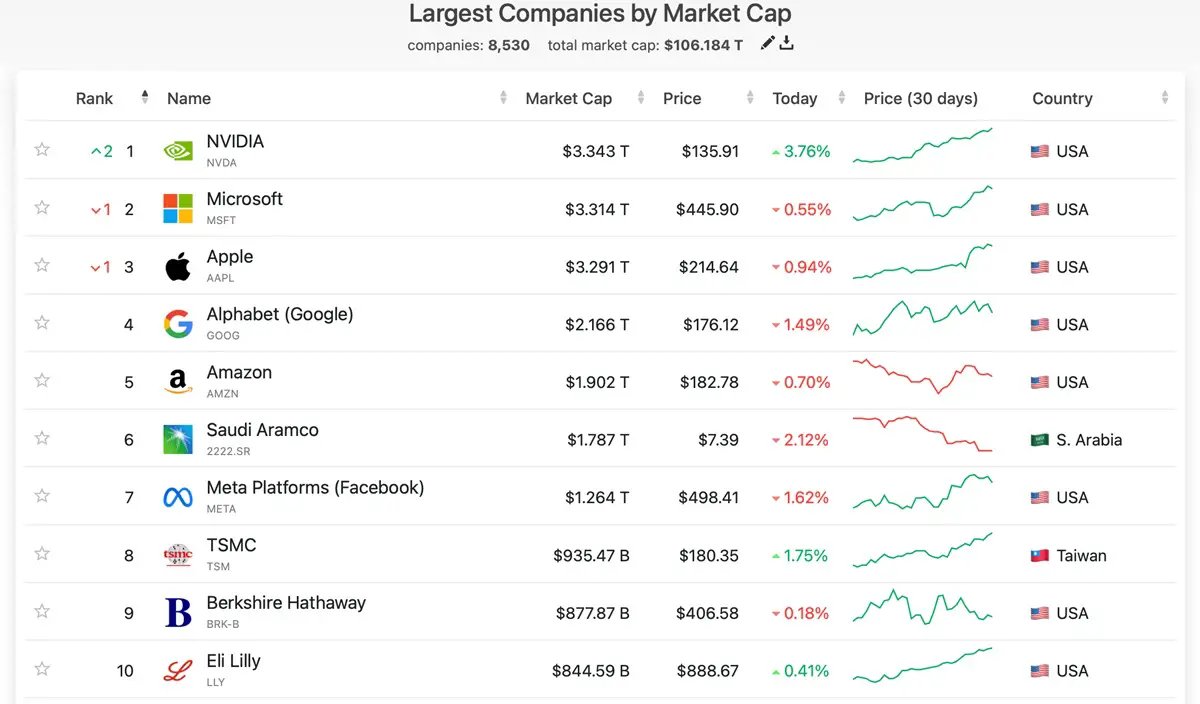

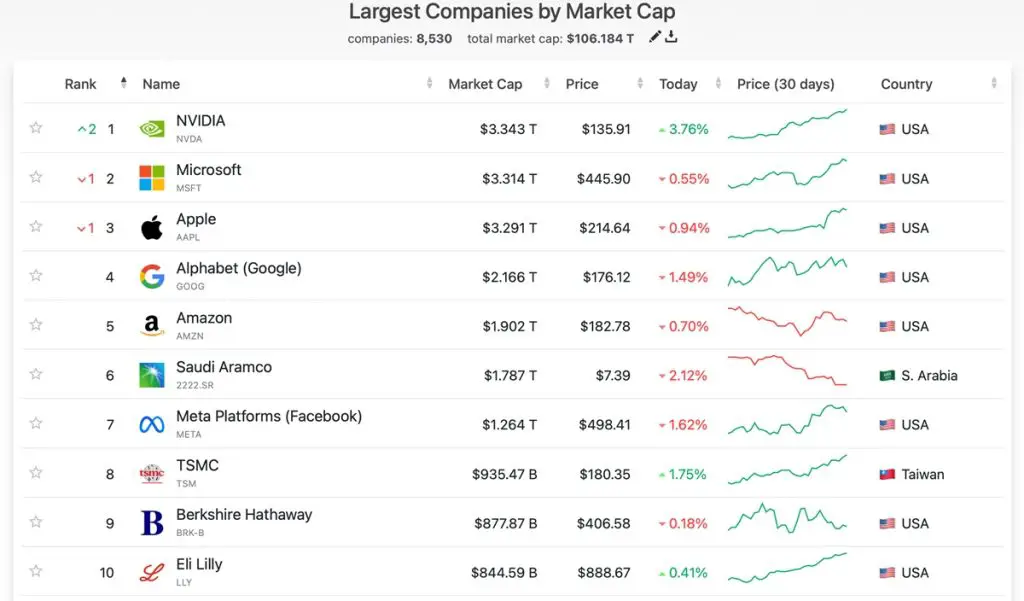

As of the close of trading on June 18, 2024, Eastern Time, Nvidia’s stock price surged by 3.51%, closing at $135.58 per share, with a total market capitalization reaching $3.335 trillion. This remarkable rise allowed Nvidia to surpass both Microsoft (at $446.34 per share, with a market cap of $3.32 trillion) and Apple (at $214.29 per share, with a market cap of $3.29 trillion), thereby becoming the world’s most valuable publicly traded company.

Nvidia’s founder and CEO, Jensen Huang, took advantage of the high stock price by selling 120,000 shares on June 13 and another 120,000 shares on June 14, totaling 240,000 shares. The selling prices ranged from $127.78 to $132.23 per share, netting over $31.18 million.

While the title of the world’s most valuable company has frequently shifted between Microsoft and Apple, Nvidia’s dramatic ascent, fueled by the burgeoning artificial intelligence (AI) market over the past year, has led many investors to believe that Nvidia, as the leading AI chip supplier, is poised to be a major beneficiary of the “next industrial revolution.” This sentiment has been well reflected in Nvidia’s stock performance since the end of 2022.

In 2024 alone, Nvidia’s stock has soared by 173%, significantly outpacing Apple’s 11% and Microsoft’s 19% gains, demonstrating its dominant market position. Nvidia joined the $3 trillion club in just 96 days, much faster than Apple’s 1,044 days and Microsoft’s 945 days. Nvidia’s strong stock performance has persisted for over eighteen months and is expected to maintain its trajectory, securing its position as the world’s most valuable publicly traded company for the foreseeable future.

Nvidia’s financial results for the first quarter of fiscal year 2025 (ending April 28, 2024) were impressive, with all key metrics surpassing market expectations. Nvidia anticipates continued revenue growth in the second quarter of fiscal year 2025, projecting revenues to reach $28 billion, with a margin of error of 2%. Additionally, the gross profit margin is expected to be 74.8%, with a variability of 50 basis points, far exceeding that of its industry competitors.